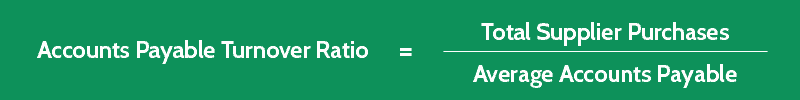

While a low ratio implies the company is not making the timely collection of credit.Ī good accounts receivable turnover depends on how quickly a business recovers its dues or, in simple terms how high or low the turnover ratio is. The calculation of the accounts receivable turnover ratio is: credit sales for a year divided by the companys average amount of accounts receivable throughout. R e c e i v a b l e T u r n o v e r R a t i o = N e t r e c e i v a b l e s a l e s A v e r a g e n e t r e c e i v a b l e s Ī high ratio implies either that a company operates on a cash basis or that its extension of credit and collection of accounts receivable is efficient. It measures short term liquidity of business since it shows how many times during a period, an amount equal to average accounts payable is paid to suppliers by a business. This tutorial explains what the accounts payable turnover ratio is, its meaning, calculations and interpretations. The receivables turnover ratio is an activity ratio, measuring how efficiently a firm uses its assets. Accounts payable turnover is the ratio of net credit purchases of a business to its average accounts payable during the period. Ned Credit Purchases: To find net credit purchases, subtract the cost of goods sold from the total purchases. It is generally calculated by dividing the total purchases of a business by the average of the total payable accounts by the company during that period of time. The formula for the Accounts Payable Turnover Ratio is: Accounts Payable Turnover Ratio Net Credit Purchases / Average Accounts Payables. The accounts payable turnover ratio indicates a companys liquidity and defines how the cash flow has been managed throughout the company.

cash conversion cycle improved from 2020 to 2021 and from 2021 to 2022.Receivable Turnover Ratio or Debtor's Turnover Ratio is an accounting measure used to measure how effective a company is in extending credit as well as collecting debts. Formula of the Accounts Payable Turnover Ratio. It is calculated by dividing the companys annual accounts payable by its.

#ACCOUNTS PAYABLE TURNOVER RATIO PLUS#

number of days of payables outstanding decreased from 2020 to 2021 and from 2021 to 2022.Ī financial metric that measures the length of time required for a company to convert cash invested in its operations to cash received as a result of its operations equal to average inventory processing period plus average receivables collection period minus average payables payment period. The accounts payable turnover ratio measures how quickly a company pays its suppliers. operating cycle improved from 2020 to 2021 and from 2021 to 2022.Īn estimate of the average number of days it takes a company to pay its suppliers equal to the number of days in the period divided by payables turnover ratio for the period. number of days of receivables outstanding improved from 2020 to 2021 and from 2021 to 2022.Įqual to average inventory processing period plus average receivables collection period. number of days of inventory outstanding improved from 2020 to 2021 and from 2021 to 2022.Īn activity ratio equal to the number of days in the period divided by receivables turnover. The accounts payable turnover ratio is a companys purchases made on credit as a percentage of average accounts payable. Accounts Payable Turnover Ratio (Net credit purchases / Average Trade Payables) In Some cases, net purchases are used in the numerator instead of net credit purchases. This means that Bob pays his vendors back on average once every six months of twice a year. Accounts receivable turnover ratio The accounts receivables turnover ratio will measure the number of times receivables are collected over an accounting. The accounts payable turnover ratio formula is calculated by net credit purchases by average trade payables. The calculation of this ratio is just like the calculation of accounts. This formula converted to a percentage shows the average amount of payables that are outstanding. Based on this formula Bob’s turnover ratio is 1.97. Accounts Payable Turnover Ratio Net Credit Purchase / Average Accounts Payables Average Accounts Payables (Beginning Accounts Payables + Ending Accounts Payables) / 2. Let’s explore the basics of accounts payable turnover, why it’s worth caring about, and how partners like Stampli can help companies to optimize their AP turnover ratio. An activity ratio equal to the number of days in the period divided by inventory turnover over the period. Here is how Bob’s vendors would calculate his payable turnover ratio: As you can see, Bob’s average accounts payable for the year was 506,500 (beginning plus ending divided by 2).

0 kommentar(er)

0 kommentar(er)