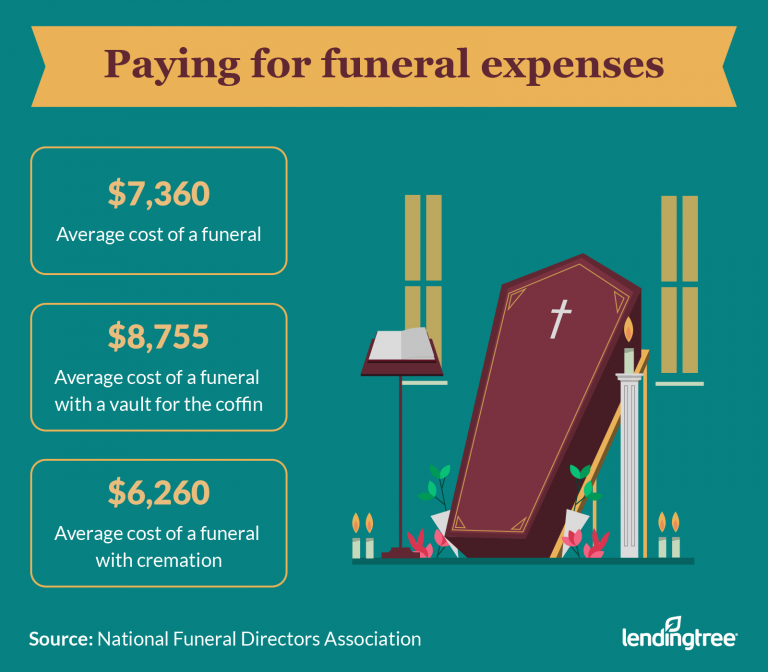

If you are the Executor of an estate and need assistance managing the estate expenses, contact a Fifth Third advisor. 1 have their own estate tax and six states 2 levy an inheritance tax (Maryland has both) as of 2020. Death Tax Deductions: State Inheritance Tax and Estate Taxesįor federal estate tax purposes, any state estate or inheritance taxes qualify for a federal estate tax reduction. Gifts given prior to the donor’s death qualify for deductions toward income tax, rather than estate tax. Before leaving a gift to a charity, have an attorney verify that the organization meets the IRS designation for tax-deductible donations. A charity must generally have a 501(c)(3) IRS designation to quality. Gifts made to charities as directed upon the death of the decedent, typically receive estate tax deductions. Note-creditors have different deadlines to submit a claim to the Executor as determined by state law. However, if the decedent had a Trust, there may be language allowing Trust funds to be used particularly for the payment of Estate taxes and administrative expenses. Executors typically use estate funds or proceeds from the sale of assets to pay outstanding debts and administrative expenses. The probate process varies by state, so be sure to check with a lawyer if you have questions. The probate process generally establishes what debts the estate owes. Funeral expenses paid by a prepaid funeral account are deductible, provided that the. Outstanding Debts Left by the Deceasedīefore distributing assets to heirs, the estate should pay any valid debts left by the deceased. plan to Inheritance Tax, as long as no other rights exist. These attorney or accountant fees and commissions are also tax-deductible. You will likely need an attorney to navigate the probate process, if necessary. All of these expenses can really add up and as executor, you need to know if you can. Estate administration expenses must relate to collecting assets, paying debts and distributing assets to beneficiaries. A funeral can include everything from the actual burial expenses and the burial plot to a headstone and casket. The estate may deduct only those expenses necessary to administer the estate. These funeral and burial expenses include: transporting the body to its burial location, tombstone and burial plot, memorial service, and other funeral related items.

The estate must actually pay for the funeral before those expenses can be deducted. The taxable estate value may exclude expenses associated with the funeral of the deceased. Accounting for specific types of expenses and taking advantage of allowable deductions can reduce the estate tax burden. For larger estates (those valued over $5,490,000 as of 2017), federal estate taxes come into play.

Financial Insights About Us Customer Service Online Banking Login Branch & ATM Locator SearchĪs the executor of an estate, settling the estate’s tax liabilities is a primary responsibility.Additional Sources of Capital for Small Businesses.

0 kommentar(er)

0 kommentar(er)